GAD guidance on calculating tax charge debits for Mandatory (MSP) and Voluntary Scheme Pays (VSP) in each of the 1992, 2006 and 2015 schemes. For more information on VSP, including proportionment guidance, please see FPS Bulletin 4.

The guidance note dated 10 December 2019 sets out the general method for assessing the debits applying to the benefits of an FPS 1992 member who elects for the scheme to pay tax charges on their behalf. For clarity, the guidance contains both annual allowance debit guidance (section 2) and lifetime allowance debit guidance (section 3).

The factors dated 28 July 2023 should be read in conjunction with the guidance note dated 7 April 2020.

| Dated | Operative Date | Document |

| 28 July 2023 | 28 July 2023 | |

| 7 April 2020 |

FPS 1992 Tax charge debits - factors and guidance (PDF, 29 pages, 599kb) - UPDATED |

|

| 24 January 2019 | 24 January 2019 |

FPS 1992 Updated tables of factors (xlsx, 45.9kb) |

| 13 May 2016 |

FPS 1992 Addendum: updated tables of factors (PDF, 8 pages, 87kb) |

|

| 21 December 2012 |

FPS 1992 Tax charge debits guidance (PDF, 23 pages, 97kb) |

The guidance note dated 10 December 2019 sets out the general method for assessing the debits applying to the benefits of an FPS 2006 member who elects for the scheme to pay tax charges on their behalf. For clarity, the guidance contains both annual allowance debit guidance (section 2) and lifetime allowance debit guidance (section 3).

The factors dated 28 July 2023 should be read in conjunction with the guidance note dated 10 December 2019.

| Dated | Operative Date | Document |

| 28 July 2023 | 28 July 2023 | |

| 30 January 2020 |

FPS 2006 Tax charge debits - factors and guidance (PDF, 33 pages, 613kb) - UPDATED |

|

| 24 January 2019 | 24 January 2019 |

FPS 2006 Updated factors (xlsx, 66.1kb) |

| 13 May 2016 |

FPS 2006 Addendum: updated tables of factors (PDF, 9 pages, 130kb) |

|

| 21 December 2012 |

FPS 2006 Tax charge debits guidance (PDF, 24 pages, 255kb) |

The guidance note dated 10 December 2019 sets out the general method for assessing the notional pension offset that is applied to an FPS 2015 member’s benefit in each year that they incur an Annual Allowance charge, and the actual pension offset that is applied to the member’s pension on retirement.

The factors dated 28 July 2023 should be read in conjunction with the guidance note dated 10 December 2019.

| Dated | Operative Date | Document |

| 28 July 2023 | 28 July 2023 | |

| 30 January 2020 |

FPS 2015 AA charges: scheme pays offsets - factors and guidance (PDF, 26 pages, 506kb) - UPDATED |

|

| 24 January 2019 | 24 January 2019 |

FPS 2015 Updated AA factors (xlsx, 38.2kb) |

| 13 May 2016 |

FPS 2015 Addendum: updated tables of factors (PDF, 7 pages, 66kb) |

|

| 11 June 2015 |

Annual Allowance Charges: Scheme pays offsets (PDF, 22 pages, 167kb) |

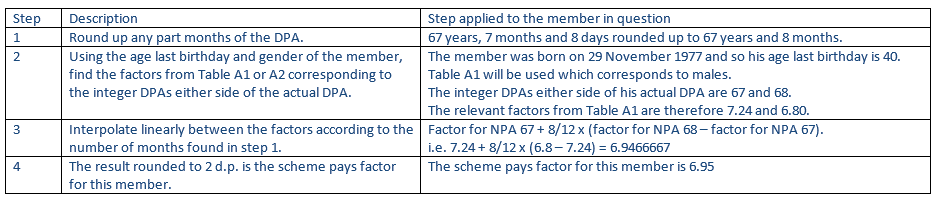

GAD has confirmed that interpolation should be used to determine the factor for calculating the pension offset for a member whose DPA is a non-integer age upon electing to use the scheme pays facility. In the following example the member in question is a male with a DPA of 67 years, 7 months and 8 days.

Please see the attached GAD guidance dated 10 December 2019 to be applied in line with regulation 179 of the 2015 regulations, relating to the reduction of benefits where a Lifetime Allowance charge becomes payable.

The factors dated 28 July 2023 should be read in conjunction with the guidance note dated 10 December 2019.

| Dated | Operative Date | Document |

| 28 July 2023 | 28 July 2023 | |

| 10 December 2019 |

FPS 2015 LTA pension debit - factors and guidance (PDF, 11 pages, 358kb) |

|

| 24 January 2019 | 24 January 2019 |

FPS 2015 Updated LTA factors (xlsx, 18.6kb) |

| 13 May 2015 |

Lifetime Allowance pension debit factors and guidance (PDF, 9 pages, 105kb) |